Frontier Emerging Markets strategy

Background

Consilium has offered a capacity constrained Frontier strategy since 2009 to qualified institutional investors via a pooled investment vehicle or a separately managed account. The strategy is focused at any given time on a focused portfolio of high-quality names having liquidity that in the aggregate matches up to investor’s needs. Proprietary models are used to screen for the best companies available and rigorous analysis to each is applied before they are included in a portfolio that also considers top down macro considerations before allocations are established. The investable universe broadly includes the countries included in the MSCI Frontier Emerging Market index as well as those countries representing an allocation of 1% or less in the MSCI Global Emerging Market index.

Opportunity

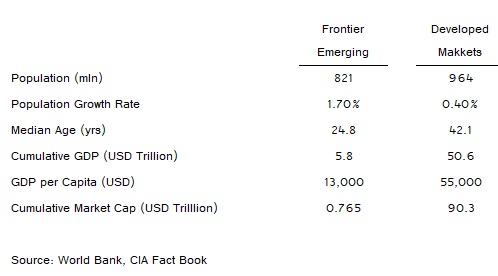

Population growth in the Frontier Markets is the fastest growing subset in the world. It is also among the poorest, though it does hold vast basic material resources and human capital. It is a largely ignored space by institutional investors and with little coverage by institutional-quality investment managers like ourselves; however those that have done their research know that the longer-term return profile is more interesting and deserving of an allocation than its perceived risk profile would indicate. Indeed, an allocation equivalent to FEM of 50% of any allocation to GEM will maximize the diversification benefits. Consumerism is on the rise with more and more people participating in their countries’ formal economies, and because of infrastructure impediments, certain technologies are allowing them to leapfrog past historical development milestones and jump right into banking and transaction products that are quickly becoming the dominant means of transacting basic business. With low relative valuations, the opportunity set is deep for interested investors.